With regard to watching the housing 'boom' unfold without oversight, disenfranchising the next generation, we can only accuse governments of callousness and indifference, if not rampant profiteering wherever possible.

Housing and the real estate industry has become a giant Ponzi scheme, and governments are happy to simply sit back and observe — when they're not busy selling off Crown land to the highest bidder themselves and taking increasing stamp duties to plump up their coffers. With rising interest rates and property already hugely overvalued in Australia, we are about to witness a train wreck in slow motion as the Ponzi scheme comes off the rails.

Well paid but highly unimpressive ministers, advisers and public servants fail to see the economic chain of cause and effect caused by allowing speculation in housing and land to run rampant. Lowering interest rates to stimulate the economy (often after a stock market crash, also caused by speculation) only leads people to irrationally pour capital into housing instead, elevating prices well above sensible returns on investment, and denying affordability to many, causing a failure of the social settlement. High mortgage repayments lead price setters such as shopkeepers to elevate their prices to cover their living costs. (However, high mortgage repayments also cause consumers to draw back from making purchases.) The higher cost of everything eventually causes industrial unrest and disruption and wage inflation, and eventually sparks a spiral of general inflation. The response is to push interest rates up again, causing more damage to home budgets and businesses. Nobody's quality of living has gone up except for real estate industry workers and the empty nesters who cashed out their homes. Meanwhile, governments keep taking things out of the CPI calculation to try to keep wages under control by hiding the real size of inflation. For some reason, you don't seem to get this story anywhere, not from the Reserve Bank, not from Treasury.

CHIRS - Community Housing Online:

With regard to the politicians, with their 2 year longview on everything:

The main barrier to progress appears to be that housing continues to lie off-centre from the main economic, social and political concerns of governments at all levels. In part, this involves an inertial lag effect. For most of the post-War period, the vast majority of Australians have been well housed by historical and international standards. Housing, labour and financial markets worked together to ensure that housing standards were adequate or better for perhaps 85 per cent of the population. A similar proportion of the population became home owners at some time during their lives. The fact that this dominant housing career and expectation has broken down over the past 20 years appears to have eluded many policy makers, who still look to the housing market operating within conventional parameters to meet housing needs for all but a tiny residualised group in the population.

It is this dominant view—along with the tendency to uncritically celebrate house price inflation as a sign of a healthy economy and domestic world—that needs to be taken head on by people concerned with both Australia's long term economic sustainability and the immediate social problems of declining housing affordability for an increasing number of Australians.

Show me the money: financing more affordable housing - Mike Berry

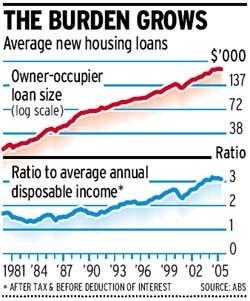

While it lasted, the boom added substantially to the wealth of existing home owners, but it has made home ownership more expensive for aspiring new buyers. In its aftermath, three questions arise. First, who financed the capital gains that home owners have enjoyed? Second, has home ownership become unaffordable for the younger generation? And third, what, if anything, should the government be doing to help young families get onto the home ownership ladder?

Rapid house price inflation also has wider economic costs, for it can distort the way we use capital. The Productivity Commission notes how, ‘Rising prices can create expectations of further price increases, unrelated to any change in market fundamentals. Young workers rush to take out huge mortgages before house prices spiral out of reach, and older buyers are seduced into investing in rental property while disregarding falling rental returns. Panic buying creates a housing ‘bubble’ which sucks money out of productive investments and eventually threatens the whole economy.’ Just as damaging in the long-term are the sociological effects of high house price inflation. The longer a housing boom goes on, the more it is likely to foster what Max Weber called a spirit of ‘booty capitalism’ emphasising pursuit of short-term windfall profits at the expense of hard work, thrift, enterprise and long-term planning. When passive ownership of a house delivers riches far beyond what most people could accumulate from many years of working and saving, traditional virtues emphasising hard work, saving, enterprise and deferred gratification are likely to get eroded, yet these are values on which capitalist liberal democracy ultimately depends. Savings, certainly, have been in free-fall. The household savings ratio, which was 10% in 1990, is now negative, and debt servicing is costing an average of 9% of personal incomes.

After the House Price Boom - Is this the end of the Australian dream? - Peter Saunders