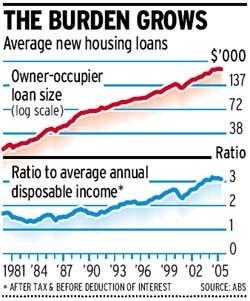

Even though home prices have stopped rising in most parts of the country, household debt continues to grow.

The ratio of household debt to income has reached a record 150 per cent - one of the highest in the world - and the ratio of house prices to disposable income is also very high by historical and international standards.

The share of households with debt secured on their home is rising, having jumped from less than 30 per cent in the mid-1990s to 36 per cent.

"The household sector remains vulnerable to a deterioration in the economic climate, and there remains a possibility that the adjustment could turn out to be much larger than currently anticipated," the report said.

Is household debt getting worse?

Note how spiralling housing costs have fed into the national debt, creating an unproductive international debt to service.

Note also that many small retail businesses are going to the wall, as disposable income is at an all time low.

What does the NSW Labor government and Australian federal Government do about it? Nothing, of course... It's far easier and politically correct to be laissez-faire and eco-rat (while still dashing off important-sounding polished speeches about nothing) and let new and prospective homebuyers (and the macro-economy) suffer.